04

CASE STUDY

MERCHANT ONBOARDING AND INTEGRATION WITH

FIRST DATA - AN APPLICATION FOR A LEADING BANK

FIRST DATA - AN APPLICATION FOR A LEADING BANK

MERCHANT ONBOARDING

AND INTEGRATION WITH

FIRST DATA - AN

APPLICATION FOR A

LEADING BANK

Introduction

- Bank X is a leading global financial institution that offers corporate and investment banking services along with wealth management solutions to a wide range of customers from individuals to small businesses, international corporates to foreign government entities across the world.

- The bank is well known for its accomplished digital banking services that cater to nearly 38 million users and offer financial services in 35 countries apart from the headquarters.

- Private companies make use of business banking and commercial banking options through this prominent bank.

Project

Web Application for a Leading Bank

Deliverables

- Concept

- User Flows

- Sitemap

- Wireframe

- Interactive Prototype

- UI Design

- UI Development

- Database Design

- API Integration

Platform

Web

Project

Challenges

The bank’s old legacy client application could no longer communicate with their payment processor because of its obsolete technology, and in addition, the bank was facing challenges with merchant onboarding, compromising the quality of their customer experience.

- Bank X had a time consuming and long drawn out merchant onboarding process resulting from outdated technology.

- The FAT application used for the onboarding process was not supported for updates by the software provider and had been missing periodic updates for a considerable period of time

- The application was not functioning effectively with First Data, the payment processor

- Productivity was affected and the bank’s customers were facing long wait times

Problem Statement

Bank X required a solution that would simplify their merchant onboarding process, address the incompatibility between applications, automate existing manual processes as much as possible and interact effectively with the First Data application. They needed a digital solution that would enable them to enhance their customer experience.

CloudNow’s Solutions

For Bank X

CloudNow assessed the challenges that Bank X was facing with merchant onboarding and FirstData integration. Upon a thorough evaluation of the requirements, we came up with an innovative solution that would follow an API based approach, deviating from the conventional FAT path that most solution providers offer.

The CloudNow

Effects

Here’s how CloudNow helped Bank X

- API-based approach simplified the otherwise complex merchant onboarding process and reduced time taken for onboarding

- API design model also addressed the issue of incompatibility between interacting applications

- Automation cut down several processes that required manual intervention related to identity validation, credit worthiness and data verification

- Automation of processes such as data capture, product selection and configuration, and signing of contracts led to reduced time delay and decreased complexity

- Upon close consideration of technical requirements for First Data payment integration, CloudNow developed a new and efficient workflow using RESTful APIs

- Built on Microservice architecture to ensure easy feature upgrades, seamless integrations and changes to meet new legal and statutory compliances and to accommodate future developments

CloudNow’s solution ensured efficiency at every stage and took into consideration future changes in requirements as well, to provide the right solution to help the bank achieve its business goals.

Out With The old,

IN

With The New

The biggest concern of Bank X was that the FAT client application which was originally used for their merchant on-boarding process was no longer supported for updates by the software provider. The technology itself seemed obsolete due to the absence of periodic updates. What’s more, the FAT application no longer worked well with FirstData, their payment processor.

CloudNow derived an out-of-the box solution, to develop a cutting edge solution to the issue with an API-based approach as opposed to the conventional FAT approach taken by most solution providers in the market.

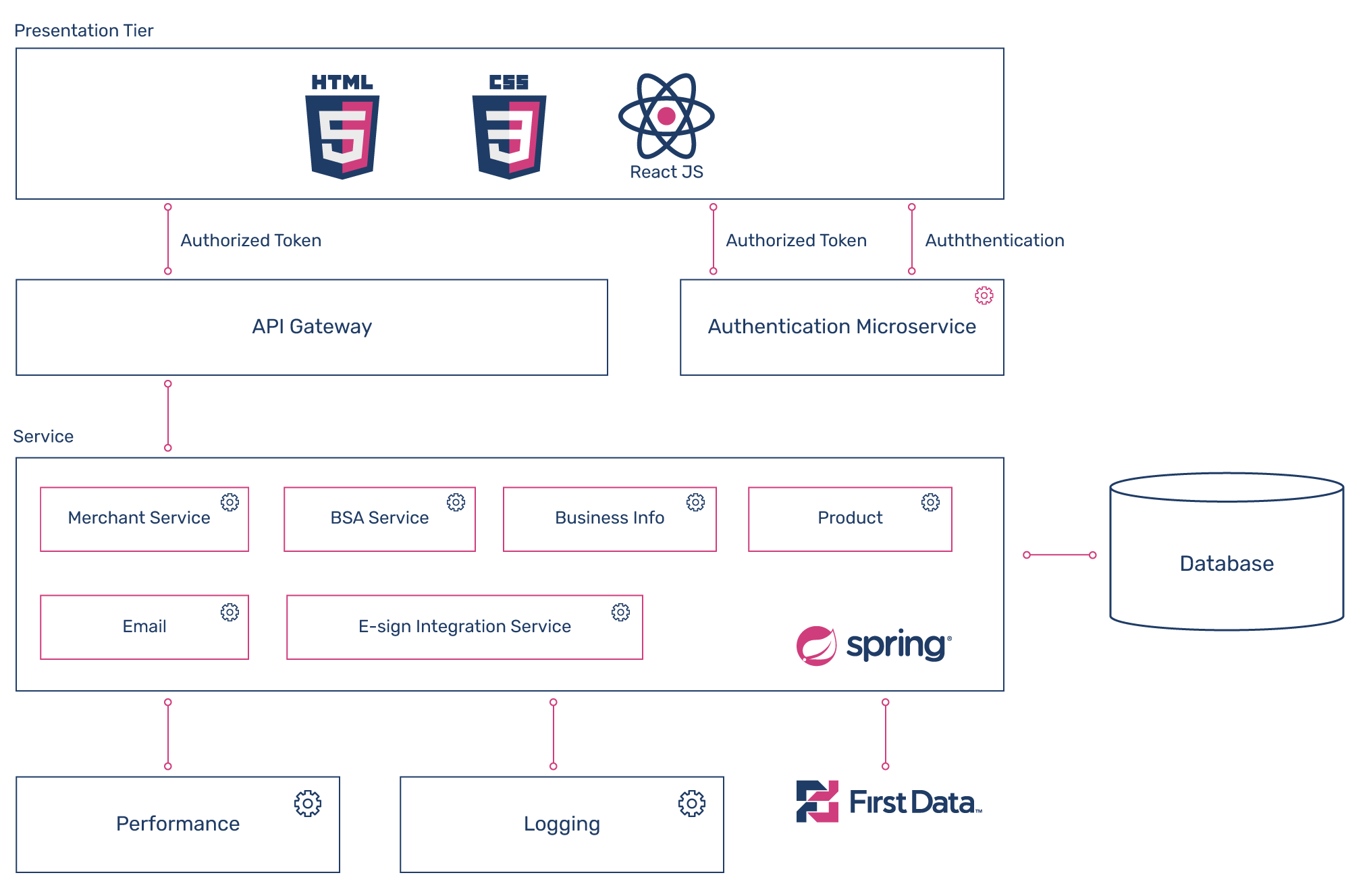

Application

Architecture

Automation for

Acceleration

- In addition to addressing the problem of incompatibility between the interacting applications, CloudNow also addressed the need to simplify the on-boarding process which used to take up a lot of time due to its complexity.

- The existing process which demanded manual intervention at multiple points -- to validate identity, credit-worthiness, and verify data for underwriting while working with third party data platforms -- had to be completely revamped.

- The CloudNow solution, by automating the process involving capturing of specific merchant business data, product selection and configuration, and signing of contracts, effectively reduced the complexity of the process and reduced the time taken at every step.

Future-Ready

solution

- CloudNow identified and took into consideration the specific technical requirements needed to integrate with the payment processor. In line with these requirements, an entirely new workflow was developed using RESTful APIs.

- The application was build on a microservice architecture, to ensure easy feature upgrades, seamless integrations and changes to meet new legal and statutory compliances as the needs of Bank X continue to evolve and change in the future.

- After all, in the competitive world of finance and merchant services, efficiency at every stage of the process is critical to profitability.

Technology

&Tools

- Front-End

- Stack

- Back-End

- Stack

- Database

- Tools

CloudNow’s solution ensured efficiency at every stage and took into consideration future changes providing the right solution to help the bank achieve business goals.

Result

CloudNow helped resolve all of the challenges faced by Bank X and offered an efficient solution that ensured faster merchant onboarding, automation of manual processes, integration with multiple applications and FirstData payment processor.